'31 South': Empowered Citizens Through Data Science & Art

- Martin Calvino

- Sep 6, 2022

- 8 min read

Updated: Oct 10, 2022

Written by Jusleine Daniel & Martin Calvino

OVERALL CONTEXT

Owning a home is a major sign of success in America. Although affordability is a major challenge to overcome for many, racial and ethnic disparities in homeownership makes it even more difficult. Equity in housing is the main component associated with overall wealth not only in the United States but in many European countries as well, with inequality in homeownership as a relevant factor of wealth inequality. Ownership of the household's main residence accounted to almost half of total net wealth in the Euro area; with homeowners being wealthier than their non-homeowner counterparts across many countries.

Homeownership can be considered an acquired behavioral trait as children exposed to parental homeownership (a process known as socialization) are more likely to be homeowners as well. Parents' tenure status and wealth also play a substantial role, and according to analysts from the URBAN Institute in Washington DC, it explained part of the difference in homeownership between African Americans and white young adults. From 1999 to 2015 for instance, young adults with parents whose wealth was $200,000 had a higher likelihood of being homeowners theirselves. However, only a fraction of African Americans parents held that level of wealth relative to white parents. Today, white parents' median wealth amounts to $215,000 compared to $14,400 for African American parents and $35,000 for Latinx parents.

Racial and ethnic gaps in wealth are an acute problem in New Jersey, with white families' median net worth at $352,000 relative to $7,300 for African Americans and $6,100 for Latinx. We now know that much of the disparity in homeownership between white people and African Americans has to do with years of racial discrimination implemented through the drawing of governmental maps that indicated areas where black residents lived and consequently were deemed risky investments. These race-based exclusionary practices in real estate are known with the term of Redlining. Although the historical processes and current implications of Redlining are having much attention today, a fact less known is that one of the primary residents of former Redlined areas are now Latinx; with African Americans comprising less than a third of the residents. This means that the long-lasting consequences of Redlining -such as poor quality housing and economically depressed neighborhoods- now affects the Latinx community primarily.

The social benefits of homeownership are well documented, with many studies pointing to increased educational attainment and civic participation, and reduced crime rates and teenage pregnancy. Taking this and all of the above, equitable lending practices that facilitate homeownership for African Americans and Latinx are of paramount importance in the attainment of improved social conditions. They are also relevant in diminishing the wealth gap, and also in ensuring the transmission of intergenerational wealth.

An impediment in equitable homeownership is -in part- ought to lending practices by financial institutions that disfavor African Americans and Latinx loan applicants across the nation. In New Jersey for instance, we experienced rejection from Investors Bank (financial institution where we had our savings) during the summer of 2021 when requesting a pre-qualification letter. Investors denied us the application papers despite having the equivalent of 36% downpayment on the house we intended to purchase and having our offer letter accepted by the owner of the house. We felt the bank response was unfair and wondered if our ethnicity (Afro-Latinx and Latinx respectively) might have played a role. We understood the bank's response might not have been in compliance with the Equal Credit Opportunity Act and the Fair Housing Act. These acts are in place to protect consumers. The Equal Credit Opportunity Act is a federal law preventing lending discrimination based on factors unrelated to a person's ability to repay. The Fair Housing Act declares it is illegal to discriminate because of race, color, religion, sex (including gender identity and sexual orientation), disability, familial status, or national origin.

We decided then, to share our experience with the Consumer Financial Protection Bureau (CFPB) and the Division on Civil Rights from the Department of Law & Public Safety of the State of New Jersey; and conducted an in-depth research into the Home Mortgage Database for New Jersey that is publicly available thanks to the Home Mortgage Disclosure Act. This Act requires many financial institutions to maintain, report, and publicly disclose loan-level information about mortgages. We wanted to know if there were other banks denying latinx applicants the opportunity of obtaining home loans and how it compared to non-latinxs.

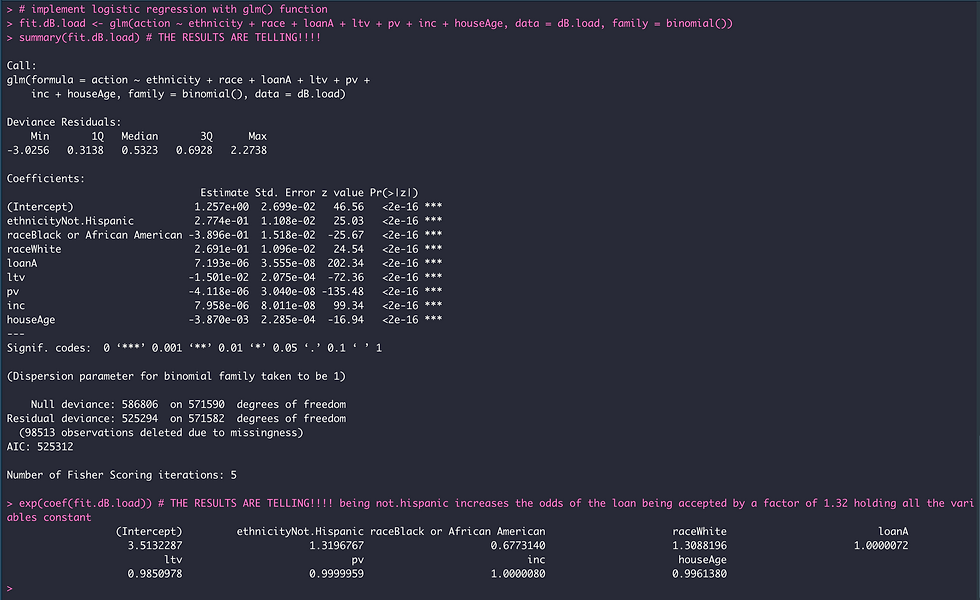

Our research involved the implementation of a battery of data science approaches written in R (a programming language for statistical computing) in conjunction with information visualization to uncover the relationship between the ethnicity of home loan applicants and the response of financial institutions toward their submitted applications. We analyzed over 1.6 million loan applications (during the period of 2018 to 2021) and found the percentage of home loans denied were higher when the applicant is Latinx relative to non-latinxs for many financial institutions in New Jersey. Furthermore, Latinx applicants were denied mortgages more often than expected, with their ethnicity being a key factor in the odds of their applications being accepted. Our results quantify how disfavored Latinxs are in New Jersey when requesting home mortgages and pinpoint financial institutions with consistently higher denial percentages towards this segment of the population.

Our work also served the following purposes: first, it provided the necessary data-driven results on Investors Bank's processed mortgages to contest the bank's response to our CFPB's submission by showing that our credentials at the time met the key metrics on loans previously originated by the bank; second, it became the generative force behind the creation of 31 South, the art installation shown here and comprising of doors as symbols of opportunity in homeownership. The installation also contains sound pieces in which the response of several financial institutions to thousand of loan applications submitted by Latinxs during selected years was sonified (translated to sound); third, it exemplifies an approach toward citizen's empowerment through the analysis and action on open data. This is because the confluence of data science research with art and communication to tackle aspects of the home mortgage industry in New Jersey from the perspective of the Latinx community, left in us not only a sense of agency and empowerment but also encouragement to raise our voice and share it with the community. The creation of new public value through the utilization of datasets provided by the government has been one of the intended outcomes of the Open Data Movement, and we hope our work becomes a playbook for Latinx citizens to engage in problems affecting their community.

OUR STORY EXPLAINED WITH NUMBERS

After we shared our experience about Investors Bank with the CFPB, the bank's official response was that we were denied the opportunity to fill out the paperwork for a pre-qualification letter because of two main reasons: income and employment history. We challenged the bank's assertion by analyzing home mortgages processed by Investors during 2021, looking at the median income for loan originated (approved) and denied not only from Investors but also from all financial institutions in New Jersey (Figure 1).

We learned that our combined income was higher than the median income for originated loans from Investors Bank. As comparison, we also look at the median income of originated loans for United Wholesale Mortgage, the financial institution that extended us the loan that allowed us to purchase the house were we live. We also looked at the destiny of all loan applications with reported income similar to ours, and learned that Investors approved 75.4% of them (Figure 2).

When looking at the reasons by which loan applications were denied at Investors Bank, we learned that employment history was not within the main reasons. In fact, less than 2% of loan applications were denied based on this premise (Figure 3).

Taking into account that Jusleine and I both perceive income from being employed, and knowing that employment history appears to be a weak reason by which financial institutions denied home mortgage applications, we wondered if our ethnicity might have played a role when Investors Bank decided to deny us the possibility to apply for a pre-qualification letter, specially knowing that soon afterwards United Wholesale Mortgage extended us a home mortgage with the same qualifications we presented to Investors. For this reason, we calculated the percentage of loans that were denied depending on the ethnicity of the applicant (Figure 4) and found that although Investors Bank and United Wholesale Mortgage denied Latinx applicants at higher percentages than non-Latinxs, the difference in denial percentages was bigger for Investors Bank.

Our observation of higher percentages of denied loans for Latinx applicants relative to non-latinxs was confirmed for the majority of financial institutions within the top 94 (in terms of processed loans) with Bank of America, TD Bank, Fulton Bank and Embrace Home Loans displaying the biggest gaps respectively (Figure 5). It is interesting to note that Investors Bank displayed a percentage of denied loans for Latinx applicants that was above the mean when all 94 financial institutions were considered, while the percentage of denied loans was below the mean for non-latinxs.

OUR STORY EXPLAINED WITH ART

The name chosen for the art installation shown here -31 South- is also the address associated with the house we purchased thanks to a loan from United Wholesale Mortgage. The installation consists of self-standing doors painted by Calvino and contains written expressions summarizing results derived from his data science research on home mortgage applications in New Jersey during the years 2018 to 2021 (see Calvino's website for details). Some of those expressions include computer code Calvino wrote in R when analyzing home mortgage data. The doors symbolize opportunity in the attainment of homeownership; and were part of the original house that Calvino kept after home renovations took place (Figure 6).

The self-standing and painted doors in 31 South also symbolize Calvino's agency in owning the narrative on his experience with Investors Bank. Calvino empowered himself by transforming his negative experience into an active dialogue about being Latinx; and the difficulties this segment of the population encounters when accessing credit to purchase a home.

Self-standing is an interesting aspect of Calvino's installation that merits reflection. The doors sustain theirselves by a counterweight mechanism facilitated through wooden dowels that go through the upper section of each door and hold them in place. It is a balancing act, stable and at the same time fragile (dowels are not nailed to the doors) , evocative of equitable lending practices in which balancing forces counterweight the need of different social groups in the attainment of homeownership.

There is a functional aspect of doors that inspired Calvino's work, they can be opened and closed. Similarly, home loan applications can be originated (approved) or denied. Calvino connected both aspects through sound art, creating sound compositions in which the binary outcome of each home loan application that came from a Latinx person was associated with the sound of an opening door (loan application was originated) or the sound of a closing door (loan application was denied). The source of the doors' sound in each composition was originated right from our house, and recorded by Calvino himself.

The sound pieces not only accompany the door installation but they also provide sonic texture to the experience, prompting reflection after careful listening. For instance, in the sound piece concerning home mortgage applications from Bank of America during 2021, a total of 1,561 applications from Latinxs were sonified from which 626 were originated and 932 were denied. Similarly, 705 mortgage applications were sonifed for TD Bank in 2021 from which 293 were originated and 412 were denied; whereas for Discover Bank 398 mortgage applications were sonified from which 57 were originated and 341 were denied, respectively.

31 SOUTH @ THE WALSH GALLERY - SETON HALL UNIVERSITY

Calvino's 31 South will be premiered at the Walsh Gallery - Seton Hall University on September 12 and will be on display until December 9 of 2022. An in-depth description of Calvino's results from his analysis on home mortgage applications will be presented on October 5 of 2022; you can register at the following link: https://shu.libcal.com/event/9553159

A pre-installation view was conducted at the gallery (Figure 7) as original intended, but because of safety and fire regulations that needed to be complied with in order for the exhibition to take place, the disposition, rearrangement and format of the doors' placement will be significantly different from the original concept.

On October 5, 2022 I introduced the project to the audience at Seton Hall University, giving a talk and offering a walking tour to the exhibition. Reporters from Futuro Media Group that produces the podcast Latino USA were present recording my talk, and I was interviewed after the talk. Latino USA has partnered with me to feature the story (and data science research) behind 31 South to bring it to a nationwide audience.

SOURCES:

Comments